How much home can you

afford?

Before you begin shopping

for a house, you should find

out the maximum amount you

can afford to pay. This is

usually limited by the sum

of two amounts: the cash

you can offer as a down

payment and amount you can

borrow.

How much can you borrow?

The first step is to shop

for a good lender. (Click

here for some excellent

tips from Jack Guttentag,

the Mortgage Professor, on

how to do this.) Guttentag

gives top scores to online

lenders

Amerisave and

E-Loan for "depth and

comprehensiveness of the

information provided," so

you may want to start with

them.

At either of these sites,

click "Calculators" on the

toolbar, then on "How Much

Can I Borrow?" (for

Amerisave) or the "Home

Affordability Calculator"

(for E-Loan) to get a rough

idea of what you can

borrow. In order to approve

a mortgage loan, of course,

a lender would need more

information about your

finances and an appraisal of

the property you plan to

buy.

|

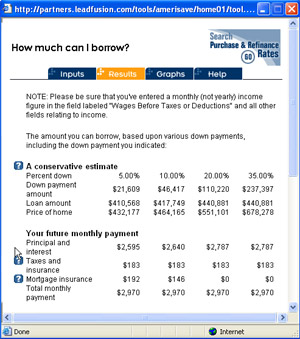

Many lender

websites have

calculators that

give you a rough

estimate of how

much you can

borrow.

|

How much should you borrow?

You'll probably be

pleasantly surprised at the

amount of money you'll be

able to borrow--loan

officers can stretch you to

the limit (and beyond) of

your ability to pay with

creative devices like

adjustable rate mortgages (ARMs),

graduated mortgages, and

interest-only loans. But

before you start house

hunting, you should think

carefully about how much you

should borrow.

Here's a

good resource for

thinking this through.

Be aware that mortgage loans

over $417,000 are called

jumbos and carry a higher

interest rate than those

under $417,000, which are

called conforming or

conventional loans. If

possible, try to keep your

borrowing below that

threshold.

See

if you can improve your

credit score

Your credit report gives the

lending industry's

assessment of how good a

credit risk you are. Since

this is one of the factors

that a lender considers

before approving a loan,

you'll want your score to be

as high as possible.

The government requires

credit reporting companies

to give you a free annual

credit report. Make sure

you go to

annualcreditreport.com

to get it. (This

government website

explains why you should

avoid all the imposter

websites that also offer

free credit reports.)

It's a good idea to check

your score early on, so

you'll have time to improve

it by fixing errors or

making changes in your

finances. This

CNN Money article offers

suggestions on how to

improve your score.

Next step: Shopping

for a neighborhood and home.

ŠLori Alden, 2008. All

rights reserved. |